Now eight months since the initial outbreak across North America, COVID-19 continues to have a lasting impact on social and economic activity. Governments have introduced measures to slow transmission and responded with varying levels of support for consumers and businesses. Corporate and consumer behaviour has evolved and adapted, as it has done throughout periods of great uncertainty in the past.

In many ways the pandemic has accelerated the pace at which new technology and systems are being adopted by companies large and small. More flexible work from home arrangements, digitization of workflows and the resurgence of ecommerce come to mind as likely more permanent changes in behaviour.

A Transformed Middle Market M&A Landscape

The middle market dealmaking landscape was not spared from disruption. We entered March on the heels of a period of time that has never been so seller-friendly. By mid-March, the market stuttered and all but ground to a halt. We saw many live transaction processes put on hold, and those sellers preparing to launch ultimately chose to delay amid rising uncertainty.

Mega deals were renegotiated or cancelled outright. Stock markets whipsawed violently, struggling to price in a new normal. Across sectors, we have a situation of “haves,” “have nots,” and “the rest,” with some fairing quite well—including technology, healthcare, ecommerce, and certain food and beverage businesses—while others struggle, with travel, leisure and hospitality, retailers, and restaurants coming to mind.

Strategic and financial buyers paused acquisition activities, turning their attention inward. Priorities shifted to business continuity plans, increased employee safety and improving work from home infrastructure. Private equity funds shored up available liquidity and worked closely with most affected portfolio companies and their financing partners. Border closures and other travel restrictions made face-to-face meetings with new management teams and in-person facility tours more challenging.

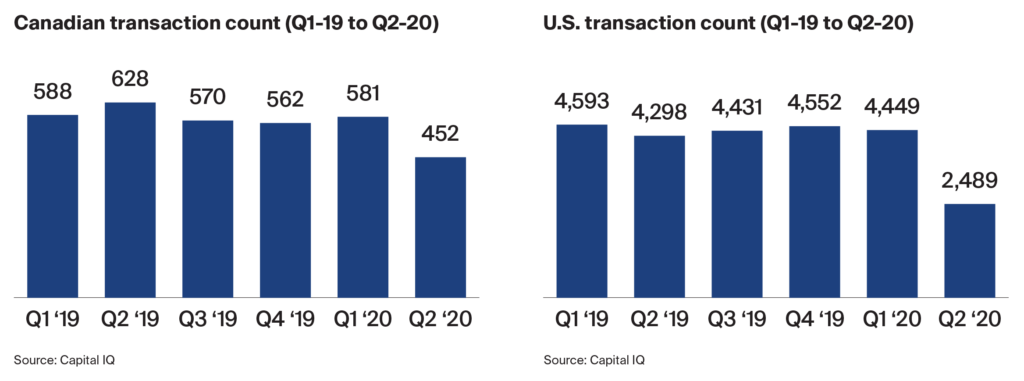

Unsurprisingly, transaction volumes on both sides of the border are down significantly year-over-year. Preliminary Q3 data showed some signs of life, as volumes partially recovered, and many transactions likely slated to close in Q2 eventually got to the finish line in Q3.

North American M&A Transaction Volumes

Yet, nearly eight months in, a stark market imbalance in demand and supply remains.

There are simply less sellers coming to market than before, with further bifurcation of this group between those that need to be in the market (i.e., requiring a capital injection) and those that want to be in the market because their businesses have shown resilience, pivoted where necessary, and are performing well. For financial sponsors, the investable universe of privately held businesses for sale that are actually performing well has shrunk considerably.

The demand for solid, investable businesses, however, remains undeterred. Private equity dry powder sits at an all-time high, while the actual number of private equity funds in the U.S. has doubled from close to 6,000 a decade ago to more than 12,000 in 2019. And these groups are finding ways to get deals done in the new environment.

The New Reality for Getting Deals Done

Over the past eight months we have helped clients progress and close many transactions while working remotely. Where travel restrictions and border closures pose a challenge to potential buyers, virtual meetings have enabled management presentations to still take place and virtual site tours have allowed buyers and sellers to connect live via technology solutions. In later stage processes, groups are leveraging external diligence providers with local market presence and hosting so called virtual “Zappy hours” with leadership teams. Transaction protocols and the way we do deals is evolving in an effort to overcome the challenges of our new reality.

Our Advice to Owners: Be Ready for the Sale

For many owners, the past two quarters have understandably given them pause. Some preparing for a sale have delayed or halted preparation altogether, taking a “wait and see” approach until markets improve. Some may not have the time to delay, due to age, health, or other circumstances.

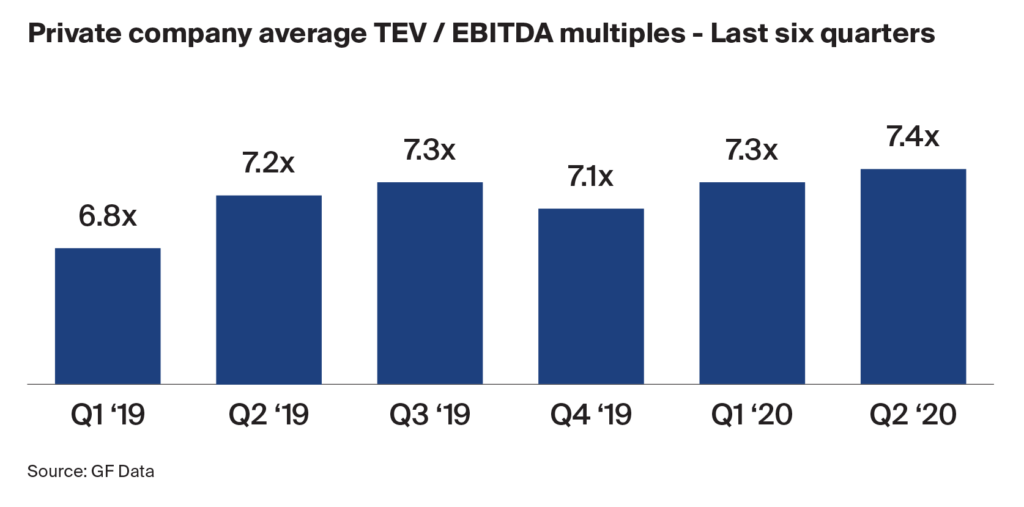

What we’ve learned and the “so what” for Canadian owners is this: pre-pandemic valuations are holding up for businesses that have adjusted and shown resilience through the crisis. Parties are finding ways to close transactions and volumes have picked up in the last three months. Owners are seeing renewed inbound interest from potential suitors. And while we never claim to have a crystal ball or practice timing the market, we are guiding owners and clients to be ready.

One tactic becoming increasingly common in recent months is advanced strategic preparation—preparing the business for sale in advance, without necessarily having a firm process launch date. Having optionality around timing of launch is important. If conditions worsen, then no harm is done. However, if conditions improve quickly, then speed to market wins the day. Those that are transaction-ready have a meaningful advantage over those less prepared.

Being prepared allows potential issues to be uncovered and proactively addressed early on, allowing business owners to use the time wisely. Those that are prepared can also react and respond effectively to inbound interest and retain negotiating leverage and momentum through a transaction to close. Those that cannot react may stumble and send negative signals to the market that could impact value and terms. Below are a few of the ways we work closely with clients to prepare their businesses for sale.

Getting Transaction Ready: A Road Map on Preparing to Sell Your Business

1. Assemble Your “Swat” Team Early On

- M&A Advisor: Acts as the quarterback who will lead and coordinate the transaction process through to close.

- Transaction Counsel: These are lawyers who specialize in M&A transaction law, which differs from a business’ day-to-day general counsel. They often have a much greater understanding of what terms are ‘market’.

- Accountants: For preparation of financial statements and transaction tax structuring.

- CIBC Private Wealth Management: Crucial to involve early on so the owner’s post-transaction plan can be implemented.

- Key Management Team: Transaction dependent, but it’s generally important to involve the C-suite early on, including the CEO, CFO, COO, etc.

CIBC Take: Assembling and connecting your team of experts early on will minimize the time required to get up to speed and allows you, as the client, to build relationships and trust with each advisor.

2. Information Gathering and Marketing Materials Preparation

- Pulling together all of the raw data and information required for a transaction is a labour intensive and time consuming exercise for the team. Starting early and staggering over several weeks or months avoids putting undue stress on a management team and reduces deal fatigue, while potentially identifying future bottlenecks.

- Drafting the marketing materials (i.e., the confidential information memorandum and management presentation) requires significant input from the owner and/or key management team members.

CIBC Take: Front-loading this effort allows us to proactively shape the narrative while mitigating and addressing any potential issues that are uncovered during the preparation phase.

3. Financial Analysis and Value Analysis Benchmarking

- Prepare your internal financial statements on a monthly basis and ensure they tie into the accountant-prepared statements.

- Identify any non-recurring items to normalize in the statements, describe trends in revenues, expenses and profitability over time; isolate and explain the impact the pandemic has had on financial performance.

- Manage your net working capital diligently and identify the normal level of net working capital required to operate the business.

- Consider engaging an accounting firm to perform a quality of earnings exercise. This is a comprehensive deep dive into the company’s financial performance, complete with a written report. With a quality of earnings report, any confirmatory diligence towards the end of a transaction should require less time.

- Identify logical, publicly traded peers or relevant precedent transactions for value benchmarking.

CIBC Take: Buyers are performing more rigorous diligence reviews as valuations trend higher and even now through pandemic conditions. Having confidence in your numbers will help build momentum and negotiating leverage.

4. Data Room Readiness

- Populating the data room early on and refreshing it throughout the process is important and ensures uniform deadlines and process momentum are sustained.

CIBC Take: Front-running potential buyer diligence requests with a fully populated data room puts the client in the driver’s seat and keeps parties fully engaged.

5. Potential Buyer Identification and Fireside Chats

- Identify logical strategic and financial sponsor buyers and collectively agree on who to approach at the time of the process launch.

- The M&A advisor can help test the market, speaking to potential buyers or lending sources on a no-names basis about their deal appetite and without officially commencing marketing.

- The M&A advisor can coordinate informal “fireside chats” with qualified high priority buyers. This can serve as a way to test market receptiveness, solicit third-party feedback, and make any necessary adjustments ahead of the formal process launch.

CIBC Take: Fireside chats are a great way to test market receptivity and identify potential gaps or pain points for buyers ahead of launch.

These are just a few ways owners and their advisory teams can prepare and move forward in this environment. We don’t know what the next six months might hold. However, those who prepare in advance and take a proactive approach will be best placed to achieve their desired outcomes.

In preparing this article, CIBC Capital Markets (“CIBC”) has relied without independent verification on publicly available information. CIBC does not, in any way, represent or warrant as to the accuracy, completeness, reliability or prudence of any information included herein and CIBC fully disclaims any liability in connection with any reliance thereon.