Cross-Border M&A: Setting the Scene

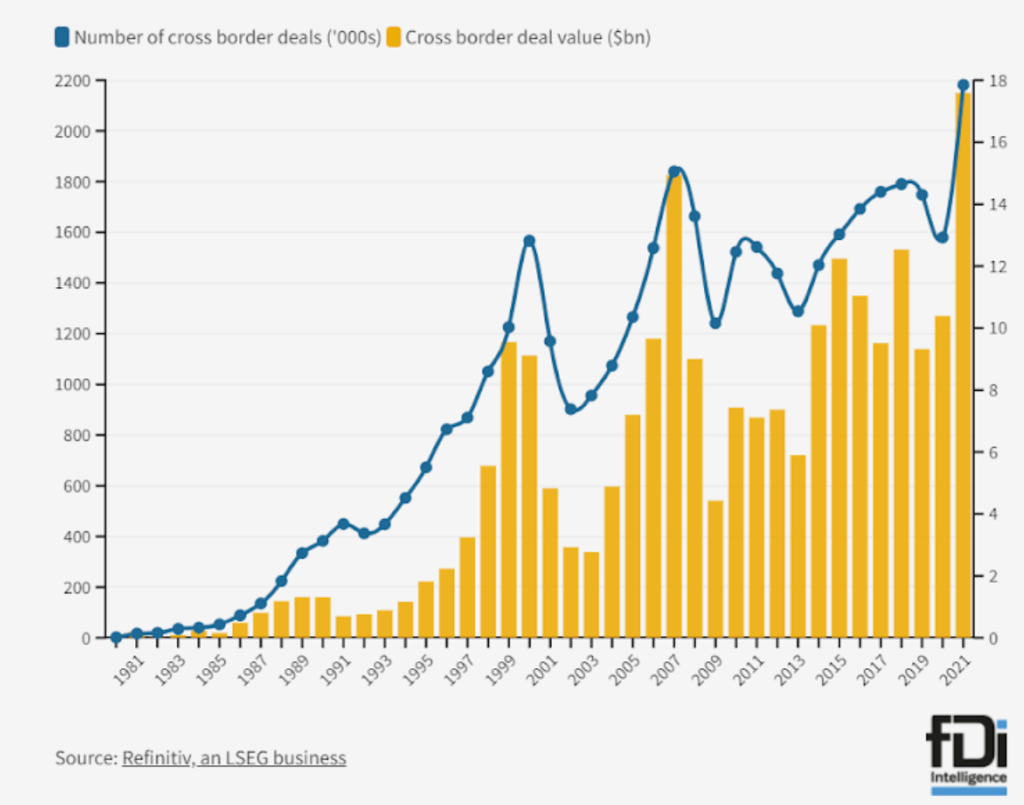

In the 20th Century, international M&A transactions were dominated by multinational corporate acquirers. In the last few decades, however, the size of strategic acquirers has decreased, and private equity firms (PEs) are becoming leading players in this arena1. Global M&A value reached $5.8 trillion for the first nine months of 20212 and the deals crossing borders are booming3.

The “Global Capital Confidence Barometer” study showed a growing interest in cross-border transactions. Amid the 2,400 executives consulted, 65% intended to make cross-border deals, with European companies as popular targets. Indeed, 39% of those surveyed by EY estimate that Europe will be the region presenting the strongest growth and the best M&A opportunities over the next three years. This prediction is leading Europe to outpace the US and Asia as the most coveted region by primary actors in the M&A sector4.

What’s led to these shifts? There are a few important factors that continue to impact the expansion of cross-border activity.

Key Factors Driving Cross-Border Activity

- Market globalization and an increasing minimum efficient size, force most corporates to expand globally through greenfield investments, or by simply purchasing an existing company in a foreign country through an international acquisition5.

- Many companies founded by baby boomers are in their expansion or maturity phases and ready to acquire other corporates. Moreover, companies established in or before the 1970s are often facing succession issues, while many large corporates perform carve-outs and other business spin-offs: a sale by one party is an acquisition opportunity for the other.

- Overseas businesses may benefit from a highly trained or low-cost labour force, a shorter supply chain, a lower cost of services/manufacturing, an expanding customer base, or access to local financing or subsidies.

- Technology advances (e.g. email, video-conferences and other low-cost communication options) allow acquirers to search for viable acquisition targets outside their own country, while greater access to quality data, improved market transparency, and the increasing presence and specialization of M&A advisors, expand the opportunities to analyse cross-border deals.

- PEs have amazing dry powder on hand and they’re deploying it in large-scale deals. They are also pursuing targets located in whole, or in part, abroad6.

- PEs’ massive array of portfolio companies generates hundreds of add-on opportunities.

- Different conditions in local M&A markets may allow cheaper deals or multiple arbitrages.

- Broad liquidity of financial markets facilitates the financing of deals (via bank financing, as well as private debt.)

From a sell-side perspective (i.e., a company looking for foreign acquirers or investors), the rationale for a deal can be diverse. Due to the temporary nature of certain industries, technologies, or markets, the shareholders may be willing to sell their company (or a division through a carve-out) to benefit from the high valuation recognized by potential acquirers. Family-owned businesses may be facing succession issues that can be solved by a new owner/entrepreneur, while loss-making, declining businesses may need to make hard decisions to ensure survival — either partnering with other businesses or selling the company to others. The option of hunting foreign buyers is critical, as it expands the number of potential bidders and increases the price competition.

Acquiring or Selling a Company Internationally: All That Glitters Is Not Gold

There are many good reasons (some obligatory) for buyers and sellers to search for foreign targets or acquirers, but that doesn’t mean it’s easy to do so. A cross-border acquirer should be prepared to recalibrate their risk perception and approach7. They should anticipate that the M&A process and the due diligence of a target based abroad (perhaps across multiple time zones) may take longer (and as a result cost more than a comparable domestic target.) They should also prevent any challenge in integrating the foreign company’s management due to language and cultural barriers.

That means that in addition to investigating the usual topics of a target company — understanding the investment thesis, commercial risks inherent in the business and the transaction, the quality of earnings, free cash flow, working capital, and debt and debt-like items — a wise investor should consider the special challenges of their international transaction, depending on the country where the target is located.

Cross-Border Considerations

International deal making poses unique challenges, with issues that require additional attention and risk-mitigation. Possible issues can stem from:

- Cultural barriers (language differences, various communication styles, formality of interaction between investor and seller, diverse habits on organizational hierarchy and business practices, low frequency of M&A transactions in the country, etc.)

- Availability, precision and viability of financial information of the target company (existence and scope of audited financial statements, GAAP differences, existence and extension of management accounts.)

- Legal and tax complexities and compliance hurdles (inconsistent levels of compliance on local country or international norms, effectiveness of current permits and licenses, transfer pricing regulations.)

- Different employee rights and grant clawbacks (crucial in case of headcount reduction plans.)

- Regulatory barriers inhibiting or changing the deal’s scope.

On the sell side, it can be difficult to find foreign buyers, especially if they are not the company’s direct competitors. Identifying possible acquirors is not the sole issue either; the seller should attract acquirers by communicating the opportunity according to the recipient’s culture and business practice, while also supporting a reasonable valuation.

Whether you are buying or selling, working with an M&A advisor, especially one with a local presence, can be extremely useful to enhance your chance of completing a swift and successful deal.

The Role M&A Advisors Play

An M&A advisor is one of many kinds of consultants involved in a deal, but the role they play is pivotal during the whole transaction. The financial advisor conceives and executes M&A transactions and other corporate finance projects, supporting large multinational corporations and small and medium-sized enterprises (SMEs) to implement global M&A transactions8.

An acquirer performs a successful acquisition when:

- They pay the lowest possible price.

- Expected results (e.g., strategic repositioning, synergies, financial results, etc.) are achieved.

- The Integration is swift and smooth.

- Post-closing risks are minimized.

In this respect, M&A advisors are there to provide relevant analysis and knowledgeable answers to their clients throughout the deal process. Each advisor oversees specific activities, ensuring that they act together, towards a plain and successful deal. To this end, the tasks of a financial advisor on a buy-side engagement may include:

- Devising a transaction and assessing feasibility with the client.

- Identifying the counterparties matching the client’s expectations and using their network, ensuring suitable promotions, or maintaining confidentiality, as needed.

- Approaching the seller (or its advisor) following a well-defined outreach process to generate as many qualified connections as possible9.

- Assessing the value of the target in each round of the deal (e.g., preliminary assessment, non-binding offer, binding offer, etc.), finalizing a fair expected band for the value of the deal.

- Making an initial offer to interested stakeholders and counterparties subject to due diligence and contract negotiations.

- Coordinating and supervising the activity of all the advisors involved in the transaction.

- Providing all relevant support to the client during the due diligence.

- Assisting the client in defining the most appropriate financial and corporate structure for the deal.

- Assisting the client in negotiating with the counterparty and/or its M&A advisor:

- The economic conditions of the transaction.

- The relevant contracts (e.g., Share Purchase Agreement, Asset Purchase Agreement, Shareholders’ agreement, etc.) and representation & warranties of the deal.

- Structuring the transaction in terms of scheduling the payments and getting agreements from all stakeholders.

- Supporting the buyer in arranging the necessary finance, as required.

- Assisting in drafting other necessary strategic decisions and schedules, like when to publicly announce the deal in the open market, or inform personnel and stakeholders, as well as when to communicate critical decisions when the deal results in layoffs, pay cuts, or other impacts on the employees.

- Drafting the outline of post-integration services across product and service lines, operations, etc.

A seller performs a successful divestment when:

- They get the highest possible valuation.

- Deal is completed in the shortest amount of time.

- Confidentiality is guaranteed.

- Warranties are issued and post-closing risks are minimized.

The tasks of an M&A Advisor on a sell-side engagement include:

- Identifying, screening and finalising a list of potential buyers (strategic and financial) together with the client.

- Contacting potential buyers.

- Preparing and distributing the informational material (e.g., teaser, information memorandum, management presentation) and supporting the customer in the preparation of the data room.

- Coordinating and supervising the activities of all the advisors/professionals involved in the transaction.

- Supporting the client in agreeing to the scope of vendor’s due diligence reports.

- Providing all relevant support to the client during the due diligence and assisting the client in responding to potential buyers’ enquiries during the due diligence.

- Advising the client on the relative merits, advantages and disadvantages of all offers received, and preparing a shortlist of the preferred bidders to proceed to subsequent rounds.

- Assisting the client in defining the most appropriate financial and corporate structure for the transaction.

- Assisting the client in negotiating:

- Economic conditions of the transaction.

- Relevant contracts and terms & conditions of the deal.

No matter the deal’s side, advisors play a critical role as middlemen, acting as buffers between buyer and seller. In fact, the parties and their management need to maintain a positive relationship so they can work together after the deal is finalized. The advisor can be at the forefront of the process, negotiating the most tedious and frictional topics (especially valuation, representations and warranties.) Conversations may become tense, and the advisor can help mediate to resolve the situation. Since the advisor won’t be in the picture once the transaction is finalized, it’s better for the advisor to be the target of some negativity than the future business partner.

The Local Advantage: Working With a Regional M&A Advisor

In international acquisitions or divestitures, the presence of an advisor may be critical.

Identifying suitable targets abroad is not always easy, and sometimes can be like finding the needle in the haystack.

Online listing portals and M&A marketplaces may be useful, however, they only introduce companies that are openly for sale where the purchase price is likely to be bid-up by trade buyers and PEs from all over the globe. Strategic buyers seeking a quality target at a reasonable valuation, and mid-market companies looking for an acquirer, will be more inclined to work with an advisor.

Global M&A firms, huge investment banks, and “Big Four” auditors can support most overseas investors, but their capacity for sourcing off-market opportunities may be hampered by the scale of the target10 or the lack of presence on local markets11.

Being in the country where the deal is taking place means that your local advisor will be clued-in on targets that are not being widely publicized, increasing the chance that you aren’t competing with other buyers for an acquisition12. Even better, would be a local advisor sporting contacts within your desired industry who can provide insight as to companies that would be open to an M&A transaction but aren’t actively in the market yet. Most M&A advisors will also be happy to scout for any off-market or “below the radar” target, applying their local relations (together with science, art, and thrust) to find hidden gems and conduct door-to-door outreach.

Even when you know the name of your acquisition target from the start of the process (e.g., it’s one of your foreign competitors or a distributor), cultural, linguistic, and geographic barriers are still in place.

Even when you know the name of your acquisition target from the start of the process (e.g., it’s one of your foreign competitors or a distributor), cultural, linguistic, and geographic barriers are still in place. Moreover, issues relating to previous relations or conflict may exist; an advisor can help in overcoming these constraints, keeping the confidentiality of the possible deal, or even masking your approach. In addition, as foreign partners’ business may seem better than it actually is, a serious M&A advisor brings a realist’s perspective and can ensure your perception aligns with the reality of the project.

In the 21st century, Language can still be a strong barrier. Despite the increasing capacity of AI automated translators, searching for detailed target information in English can be frustrating. Language differences where the target’s owners, management and staff do not speak English, and financial records that are not maintained in English, are still frequent even in countries like Italy, Germany, and France. In many cases, it is recommended to engage bilingual advisors if adequate language resources are not available in-house on the acquirer’s team.

Using the right approach to a potential target is another bonus of the local advisor. M&A transactions may still be uncommon in the target’s country, with family businesses passed between generations, rather than being sold to a corporate or private equity acquiror. M&A sales may be seen as a symptom of an impending bankruptcy (customer, suppliers, and employees may need to be reassured), middle market companies can be inexperienced having never sold a business before (especially to a foreign player), the company can be without an advisor, or have one inexperienced in M&A. The knowledge of national and local communication and negotiation styles may be key to ensure that a slow or vague response, or an unknown holiday, be contextualised and not misinterpreted as a sign of lack of interest by the counterparty.

In an acquisition, the business-specific culture will also be easier to discern if the advisor is able to visit the target personally or, at least, have detailed phone conversations with the entrepreneur or the management (when existing). Videoconferences, email and other low-cost communication options certainly have helped foreign buyers and sellers, however, the diversity in cultural norms and other cultural gaps need to be bridged during the entire process. From scouting, to negotiations, to the due diligence, and up to the final negotiations of the share purchase agreement, avoiding cultural shocks can require coaching from the advisor for both parties, with buyer and seller willing to learn and adjust.

While astonishing price multiples can garner much of the attention, successful buyers know that failing to plan for the culture of the target may prevent the synergies that justified the deal in the first place from being realized. Keeping in place members of the target’s management team, as well as most of the current executive-level processes, will benefit a foreign expansion. Therefore, it is crucial to cultivate relationships with the target’s key people early in the deal process to win their support and ensure their retention after the closing13. It’s tough enough for companies in the same country to ensure a cultural fit when contemplating a transaction: the involvement of a foreign acquirer adds new complexities, including language and business practices.

When selling a company or carving-out a business, a wise local M&A advisor may help finding suitable buyers worldwide and adapt the communication of the equity story to the recipient’s culture and business practice.

The advisor can also provide the right framework to read certain behaviours of the seller, thereby reducing the risk of misinterpretation and mitigating certain buyer’s concerns14. On the sell side, it is also important that the target’s local management support the new owner during the integration process, and for emerging-market buyers, in transferring advanced management knowledge and technologies. Doing so will reduce the buyer’s risks and win the new owner’s cooperation. A domestic advisor can assure and coach local management that the transaction is part of a smart, synergic strategy and not a pure imperialist move.

A local firm can also assist in navigating bureaucratic and regulatory mazes by developing crucial relationships with important stakeholders and advisors15.

According to a recently published survey: “Acquirer firms are more likely to hire a financial advisor in the acquirer’s country to advise a cross border acquisition, the greater the institutional distance between the countries. And, acquirer firms are more likely to hire a global financial advisor to advise a cross border acquisition the greater the geographic distance between the countries. Possibly, geographic distance increases the difficulties in studying a potential distant target, in addition to the costs that arise from distance that are hard to overcome using the communication technologies. In these instances, a global financial advisor may be a viable alternative. In terms of the institutional distance is reasonable to influence when we consider that hiring a financial advisor can be perceived as a guarantee that it will be better able to navigate through an array of institutional differences”16.

How to Select the Right M&A Advisor for Four Cross-Border Deal

M&A advisory service providers range from big investment banks to small boutique firms. Be selective: you need to assess what is right for you in several aspects. When you are searching for support in your cross-border transaction consider multiple possible advisors, and create a shortlist based on the following considerations:

- Assess the possible advisory firms in relation to their expertise on the markets, regions, products-line, or any other applicable parameters which are the core agenda for your deal. Look for a firm that will expand your options through the farthest and right-focused geographical reach.

- Verify the potential advisor’s access to data platforms suitable for the search you will perform (a small private company, a listed competitor, a strategic buyer, a PE with portfolio companies synergic with yours, etc.)17

- In the news, we frequently hear about massive M&A deals happening between big corporations. Big investment banks typically broker these large-scale deals, which means these global entities typically don’t represent companies in the lower to middle markets because the revenue incentive is not high enough for them. Moreover, M&A and IPO scales quite often determine the nature of work involved. In smaller deals there is a lot less regulatory scrutiny to handle, and often extensive roadshow or book-building processes are not required. Here, it’s the human touch and the daily attention to minor features that are the key to success.

- Check the advisor’s network of professionals. A cross-border deal usually includes the involvement of local legal, accounting and tax experts, sporting a deep knowledge of domestic laws and principles. The advisor’s capacity in introducing multiple possible specialists expands your options.

- Understand if the advisor’s track record fits with your target in terms of deal size, transaction type, and value creation. Seek out any available testimonials from their clients and look for a firm that has tested relationships. Check the news for any legal, operational, financial, or other challenges experienced in the market.

- Assess the advisor’s skill to find targets locally or, when you are on the sell-side, to create a competitive bidding scenario among multiple potential investors.

- When selling a business, most owners trust their accountants for a fair valuation. While this works well for an initial assessment, accountants may lack other crucial expertise in areas like proper marketing, networking, and bringing in interested parties to offer you the best prices. Choose an M&A advisor who is well known for these aspects. Select an M&A advisor and not just a business broker: the broker’s job ends when the deal is complete, while M&A advisors work with clients to clearly detail long term plans, structuring, and other aspect of business transfer or integration.

- Before approaching a possible partner, draft a realistic valuation for the expected deal. Backed by the SWOT analysis on your company or the target transaction, discuss the advisor’s view on the deal structure and valuation, understand their rationale and then benchmark their fees and charges.

- During the interviews, assess if the advisor is aligned with your goals and motivated to get you exactly what you want, or if they seem rigid in their own perspective or bias. You want your M&A advisor aligned with your vision and goals.

- When you are interviewing M&A advisors about their process, ask: What is the first step and how will that set you down the right path to success? Can they walk you through an example using a previous client?

- Consider how the advisory fees are structured (usually, they include upfront fees, monthly fees, LOI/sign-up fees, and success fees.) Trust only advisors with transparent fees, well-built around the deal’s scope. As the deal is crucial to the success of your corporate or personal strategy, this probably isn’t the time to cheap out. Consult resources like the Firmex M&A Fee Guide to establish a reasonable benchmark.

- Factor other likely deal costs (attorneys, due diligence and structuring advisors, data room expenses, financing fees, notarial charges, travel expenses, etc.)

- Look for an M&A advisor that welcomes constant engagement, active contributions and involvement from their clients. Leaving any decision to the advisory firm simply because you are paying a fee is not advisable, as it leads to important details being missed, assumptions being made and lack of commitment and clarity, which ultimately leads to future challenges, setbacks and risks. Look for a true collaborator.

- Finally, remember that M&A deals are long and sensitive processes, therefore, you should feel comfortable and have a liking for the people with whom you are working, and feel confident in their abilities to get the deal done right.

The Best Resource for a Cross-Border Deal Future

M&A is going where customers, technologies or resources are. That means that cross-border M&A will make up an increasing share of global deal making activity.

In these endeavours, it is crucial to engage a specialized advisor with local expertise, insights, network and take-over knowledge. We suggest large corporate and PE players consider venturing outside their usual circle of deal advisors and engaging a local team. For smaller businesses, a business deal is a once-in-a-lifetime opportunity, which may make or break the entire personal wealth of the entrepreneur: it becomes very important to select the right partners.

The role of a local M&A advisor cannot be underestimated. They are the best resource to help you formulate a buy-side or sell-side strategy, identify viable targets or buyers, conduct outreach, provide day-to-day coordination of overseas due diligence with multiple teams that cross multiple time zones, and manage multi-cultural negotiations culminating in a successful close.

Keep in mind, M&A advisors, even if engaged for a long term, will eventually move on. In the end, it’s all about the principal. The buyer or the seller needs to be in control from start to finish for the objective of merger, acquisition, or divestiture deals, and being in control means leveraging the best supports out there. Constant involvement, assessment and joint working with M&A advisors will not only make the deal clear, smooth, and easy, but will also provide long-term benefits. By collaborating with an M&A advisor, owners have an opportunity to hone their business acumen and skill during the process, leading to more informed, experienced and prepared dealmakers in the future.

1 A.Irwin-Hunt, In 2021, private equity deals weighed 36% of the total deal value, Fdiintelligence. https://mergers.whitecase.com/highlights/global-private-equity-delivers-groundbreaking-2021#:~:text=With%20a%20total%20of%208%2C548,doubled%202020’s%20US%241%20trillion.

2 N.Nishant, Global M&A volumes hit record high in 2021, breach $5 trillion for first time, Reuters, Dec 31, 2021.

3 Cross border M&A reaches all-time high of $2.1tn in 2021.

4 J.Stuij, Innovation and digital resources support cross border dealmaking, Dealsuite, August 09, 2021. The transcontinental interest towards the EU is not new. In fact, “Favourable valuations, strong infrastructure and strong economic growth were the top three factors that attracted buyers to EU. Technology/IP, brand name/reputation and plants/facilities were the top three factors that respondents say attracted buyers” according to Mergermarket/Orrick, Inward bound – Inbound M&A into the EU, 2016.

5 Entering a new market battling for share is usually very expensive.

6 “[PEs are becoming more like a corporate investor] …albeit one that is more efficient and aggressive in all respects. That means using scope and scale deals to add large assets to equally large platforms, capturing synergies and playing the same game as many corporations, only with a higher bar”, Bain & Co., Global Private Equity Report, 2018.

7 According to a panel of corporate dealmakers, meeting sellers’ price expectations due to competition for quality assets, volatile economies and transparency issues were the top three obstacles in agreeing to the deal. Mergermarket/Orrick, cited work.

8 The availability of a focused M&A support may be the key to win a contested deal or to generate off-market opportunities also for serial investors.

9 Sometimes also masking the real bidder, at least in the first steps of the process.

10 Small M&A targets mean low deal value and hence less commission and fees for M&A advisors, thus reducing larger firms’ interest to work in this space.

11 Many countries have specialised industrial districts and they are usually far from the main financial cities where are located banks, insurance stock exchange and the headquarters of the largest corporates (e.g., the Italian “Motor Valley”). Sometimes, larger advisory firms do not operate with expertise or network at granular regional levels.

12 The EU legislation, for instance, is mature and sophisticated. This makes it difficult for foreign investors to compete with local buyers who have experience dealing with local regulatory matters and are better resourced to carry out the deal.

13 BCG, BRICs versus mortar – Winning at M&A in emerging markets, 2013.

14 The lack of detailed commercial data is perceived by the potential acquirer as the seller’s will to retain certain information that might negatively impact the business valuation. In Italian family-operated companies, rather, this is usually due to the widespread lack of sufficient management control systems.

15 Talk to local experts when acquiring in the EU. Many of the difficulties faced by acquirers in our study are manageable, provided advisers with local knowledge and contacts are used. While the EU provides frameworks for regulatory regimes, national implementation can vary considerably. Mergermarket/Orrick, cited work.

16 L.Orozco de Gouveia, M.Portugal Ferreira, H.Rodriguez Ramos, How Hiring Financial Advisors in Cross-Border Acquisitions in the BRICS is Driven by the Target Country Institutional Image and Home-Target Distance, Revista Base (Administração e Contabilidade) UNISINOS, vol. 17, no. 2, 2020.

17 J.Stuij, Innovation and digital resources support cross border dealmaking, Dealsuite, August 09, 2021.