Mid-market dealmaking in North America has thrived for the last 18 months — but what factors are driving this boom? We asked five leading experts for their take on what’s moving in the mid-market.

Fill out the form below to download the full report.

Foreword

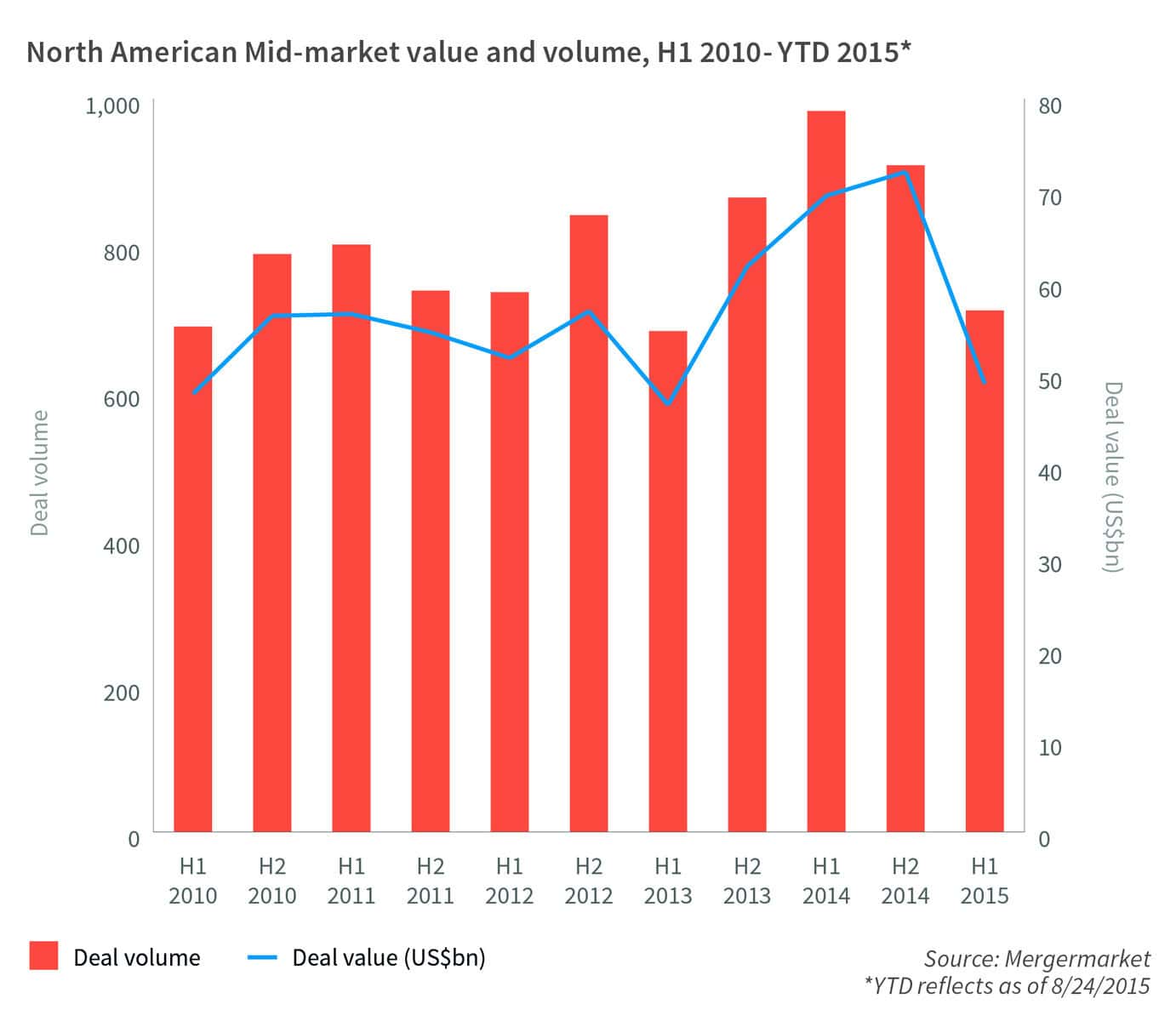

After a great 2014, mid-market M&A in North America is finding its feet again. And although deal numbers are down, the industry has been in a confident mood for 2015’s outlook.

Our previous North American mid-market M&A study, from February, found that 88% of respondents expected US and Canadian mid-

market M&A to rise in the coming year. Driving this primarily would be the desire to hit growth targets and non-core divestitures.

Over six months later then, is this happening? According to our expert panelists, shifts are certainly taking place, with companies using M&A to grow. On top of this, mid-market firms are becoming increasingly sophisticated, helping them to compete on a level with bigger

companies. And while private equity activity has slowed down, corporate strategic buyers have taken their place.

Mid-market M&A is robust, and current conditions are favorable for conducting deals. Yet as competition increases, the mid-market needs

to increase its focus in order to succeed.

Mergermarket (MM): What has been driving mid-market M&A in 2015?

Cornell Wright (CW): There are really five factors. The first one – and least intuitive one – is the aging population. The baby boomer generation is nearing retirement, and they are looking to monetize their assets by selling their businesses. Secondly, the availability of cheap credit is favorable for borrowing and conducting leveraged transactions. Thirdly, private equity funds continue to be flush with cash, and pressure from investors to use that cash will continue to drive their activity. Fourthly, there continues to be strong public company valuations, giving strategic buyers more purchasing power and confidence. And finally, the market is generally quite robust. On an organic-growth level, GDP is relatively limited. For companies looking to grow, inorganic growth through M&A seems to be the way.

For Canada, the mid-market is very important. It is a country that has a lot of large-cap institutions, and the mid-market is an area we see with great growing opportunity.

James Roddy (JR): There is always a significant focus on consolidation in any M&A strategy. However, these days, the M&A market balance of consolidation versus growth is tipped towards growth. Lessons have been learned from the recession. Hitting the earnings-per-share target is not the challenge, it’s about hitting revenue targets. With this in mind, companies are now focusing on buying for growth.

The capital markets are showing their support for growth M&A by how they trade the acquirer following an M&A announcement. Historically, acquisitions were met with the acquirer’s share price coming under significant pressure. However, in the last few years we’ve seen the average acquirer’s share price react positively following an announced deal and the amount of positive reaction in the acquirer’s share price has been growing.

Josh Benn (JB): It’s a combination of growth and consolidation. There is a natural evolution happening in a lot of categories, where you’ve got some newer businesses that are capturing share, or they have a new product or service that is superior to the offerings in the market today. Those companies are growing organically and as a result they see an opportunity to capitalize on it. They can bring in capital to accelerate that growth further, potentially to take advantage of some niches or other opportunities they are not yet capitalizing on.

As Cornell said, you also have a lot of aging baby boomer owners of businesses that see this market as being very receptive. Valuations have been strong as a result of the substantial liquidity that’s out there both within the debt financing markets as well as the private equity community and on strategic buyer balance sheets. Financial and strategic buyers have both been active. The organic growth environment overall is still somewhat challenged, so a lot of companies need to consolidate other businesses into their businesses in order to drive earnings growth. These strategic buyers want to deploy that cash towards things that are driving earnings growth as opposed to reducing the number of shares or giving cash back to shareholders.

Steve Sapletal (SS): We’re seeing a combination of both growth and consolidation. In the mid- market space, in terms of growth, we’re seeing many firms look for geographic diversification. On the other hand, companies are also consolidating by cleaning up their portfolios and selling non-core assets. The strong US dollar and selling assets is putting these sellers in a solid position to use the cash gained on new and focused growth assets.

One thing I would say is that for mid-market firms, the M&A teams are becoming much more experienced. They are hiring intelligent, well-run M&A professionals — it isn’t just the CFO anymore. On top of this, a majority of these people are joining from larger firms.

The mid-market acquirer now is more advanced than five years ago. It’s also a reason we’re now seeing an M&A uptick — the deal teams are more sophisticated.

Mike Hollander (MH): I have to agree with both Steve and Josh in that we’re seeing a drive from both growth and consolidation. We’re seeing now a tremendous focus from corporate buyers that we haven’t seen for the last several years, and I think they are looking to buy and consolidate to drive growth for themselves. I think large-cap growth will slow down as they’re trading at healthy valuations so they’re looking to acquire mid-cap companies to continue to drive their growth.

“There is a natural evolution happening in a lot of categories, where you’ve got some newer businesses that are capturing share, or they have a new product or service that is superior to the offerings in the market today.”

— Josh Benn, Managing Director, Duff & Phelps

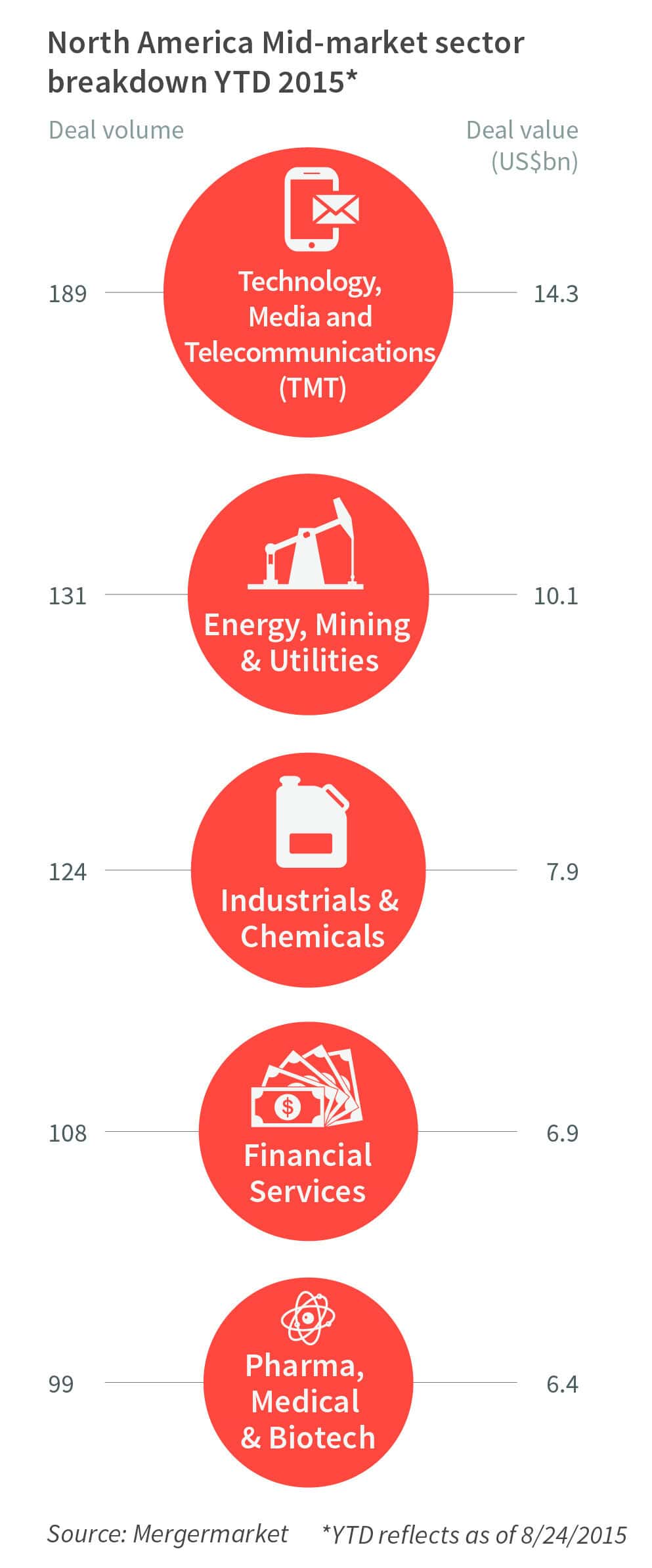

MM: What is proving to be so attractive about mid-market technology companies?

CW: The main thing here is innovation. Companies face a real pressure to innovate in today’s changing world. With this in mind, large companies are buying smaller firms to enhance their technological know-how and accelerate growth.

JR: At a base level, they show similar attractive growth characteristics that the market is rewarding as I mentioned previously. In terms of the industry itself, the advent of things such as cloud computing and software as a service are giving technology companies the ability to have a global presence, despite being extremely asset light.

From the acquirer’s perspective, public strategics are looking for growth and have low cost of capital. For tech firms in particular, they are facing pressure from

activist investors to do something with their cash. Estimates show that one in five activist campaigns are in this sector. So when you look at it, the attraction has been borne out of a revolution both in the industry itself as well as from today’s market pressures on acquirers.

JB: Technology is obviously very desirable. There is a foundation of well-capitalized strategic buyers in the tech space that they are continually feeding their development and IP pipelines by acquiring new and emerging businesses. Currently, tech happens to be bubbling — I won’t say there is a bubble, but some of the valuations that are being achieved by new pipeline tech companies are astounding, and are starting to become reminiscent of the 2000s.

You also have in the tech space some incredibly successful and aggressive PE firms that have become really active. Those guys have all done a tremendous job in acquiring technology companies. You really just have a broad cross- section of buyers for tech companies and in a lot of cases it’s easier to buy than to re-engineer or build intellectual property or tech products they are buying. As a result, the public equity markets are rewarding those sophisticated technology acquirers that are buying new and emerging businesses. In addition, the successful private equity firms are able to raise substantial new pools of capital to perpetuate their strategies.

SS: A lot of mid-market tech firms are nimble, and in some cases have carte blanche — they are given time to develop products and make their name. A lot of bigger companies are looking at them for expansion. For instance, when larger biotech firms were after smaller ones, it was about getting their R&D. Big companies can often have a stifled R&D, and so naturally look to smaller firms who often have room to maneuver in that space.

“We’re seeing now a tremendous focus from corporate buyers that we haven’t seen for the last several years, and I think they are looking to buy and consolidate to drive growth for themselves.”

— Mike Hollander, Principal, GTCR

MH: Tech companies have tremendous recurrence of cash-flow, generally, because they are subscription-based models. They also have high cash-flow conversion because generally they don’t have tremendous capital expenditure or net working capital needs. If they have the right model, they tend to have a very sticky customer base. This means there are a lot of baseline things that are attractive about tech companies that attract both corporate and PE buyers. We like investing in tech firms because they have great growth, cash-flow and margin characteristics.

MM: How are mid-cap acquirers coping with competition from larger companies?

CW: Bigger firms have the capacity to be acquirers, and can be formidable competitors for mid-market equivalents. However, the real issue is that larger companies have more experience in terms of deal execution. If you’re a mid-market company competing with larger, more established buyers, you need to think about how to deal with the operational, financial, legal, tax and cultural issues intrinsic in sophisticated M&A transactions. You must have a concrete plan in place, with a good corporate development function to compete.

JR: We aren’t really seeing a difference in the current investment cycle versus previous competitive dynamics. The mantra is still: “He who sees the most strategic value and pays, wins.” Of course, there are scenarios where big firms are willing to pay a premium for an asset, and with their larger capital base it is easier for them to do so.

However, mid-cap acquirers can combat this to some extent by articulating to the target that going to a mega-cap acquirer may mean that they could end up being assimilated and stripped of autonomy. But this has been the case for a while, and in the current M&A cycle, not much has changed in this regard.

SS: The dynamic hasn’t really changed. What I tend to find is that mid-market firms are becoming more unique. They are doing joint ventures with investment vehicles, accessing unique financing opportunities to go after larger firms. They are becoming more nimble when it comes to financing.

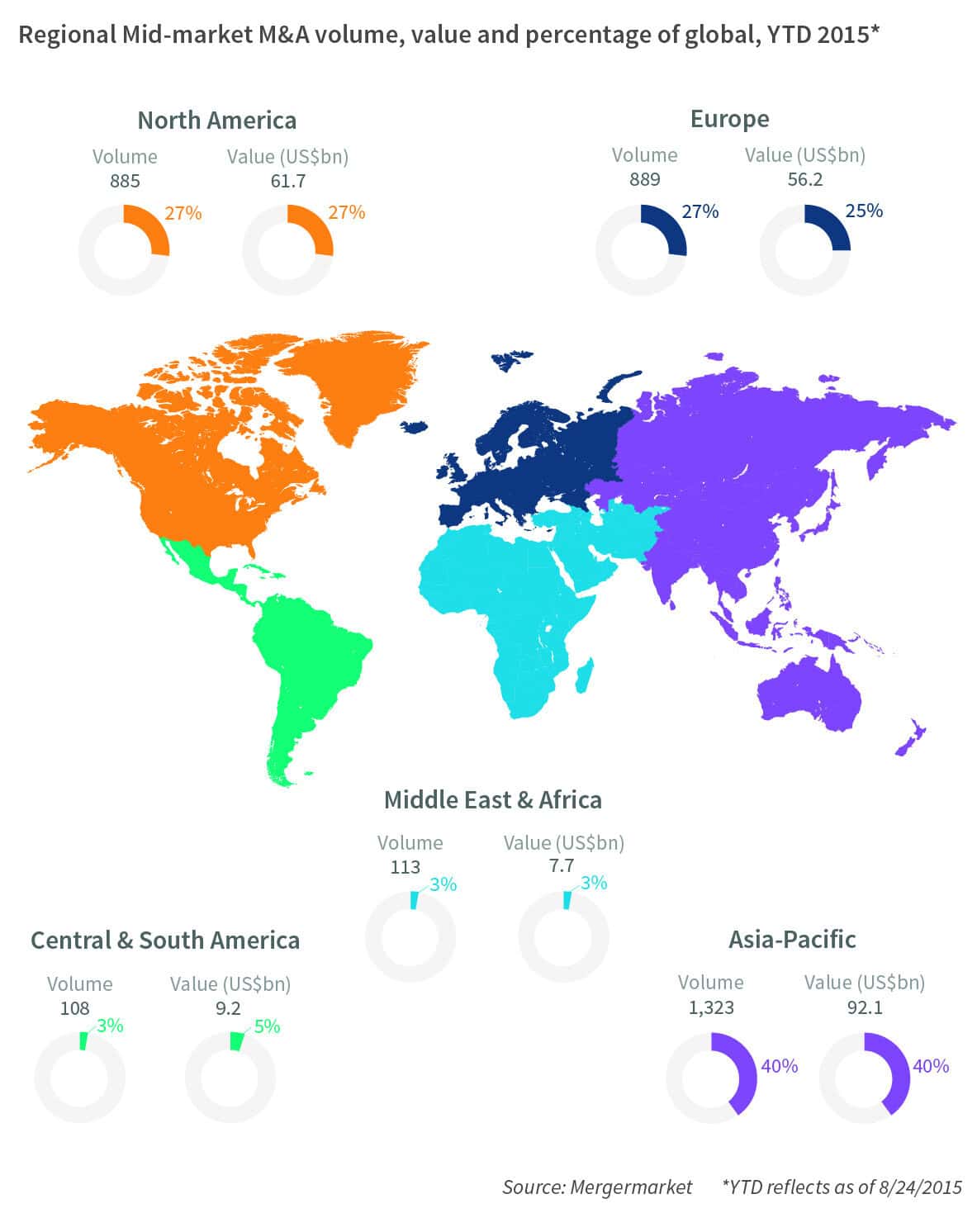

MM: Asia-Pacific companies in particular seem keen on North American companies. What is attracting them?

CW: Firms from places such as Japan, for instance, are seeking to diversify and acquire technology and intellectual property. On top of this, they are also looking for brands that they can leverage and develop. It’s about looking to enhance what you have, as well as gaining access to a vibrant platform for future growth.

JR: Deals from Asia-Pacific coming into North America are up around 100% so far this year. The drivers behind this are two-fold: a push and a pull.

The push driver is Asia’s investment asset allocation strategy. There is a lot of capital in Asia now that is looking for direct investments. China Investment Corporation has established funds explicitly for the purpose of investing in overseas economies, and the US is a core focus of that.

The pull driver is the fact that the US market is a great place to invest. If you look at the numbers, US GDP is growing at around 2%, while Europe is at about 1.5% and Latin America is basically zero. On a comparative level, the US is the place these Asian funds want to be.

JB: The US has the healthiest economy in the world and there is a lot of fear in Asia right now. China has been really volatile — I think it’s the same principle that is causing foreign buyers to buy apartments in New York City. American brands are generally well regarded around the globe and so for foreign companies to be buying businesses in the US, it’s a safe place to be parking their resources. In a lot of cases, they can export the brand back to the countries where they’re headquartered. Its almost a double benefit to them.

SS: Asia-Pacific firms usually buy here because regulations are generally easier to deal with in the US. But what we see now is that Asia-Pacific companies are coming to the US to buy brands. They might have a niche or specialization, and they are coming to buy brands so that they can bring their products into that brand’s portfolio.

Countries such as India are also buying here for technology. This is a complete role reversal. Before, US firms often outsourced to countries such as India. This trend has now reversed. Onshoring is the new offshoring. Similarly, places such as Hong Kong are looking to the US as a way to lower costs. That is a dramatic shift from five to ten years ago.

MH: Asia-Pacific companies are looking to access a US customer base. The US economy remains robust versus many geographies and I think the companies in Asia, well, before the recent market corrections, were trading at very high valuations. I think they were looking to capitalize on those valuations by buying firms that have access to US customers because the US customers are very valuable for any business.

“Asia-Pacific companies are looking to access to a US customer base. The US economy remains robust vs. many geographies and I think the companies in Asia, well, before the recent market corrections, were trading at very high valuations.”

— Mike Hollander, Principal, GTCR

MM: How have BDCs and other financing initiatives impacted mid-market M&A?

CW: While we do not see much of BDCs in Canada, they offer the ability for companies to access the capital they need to grow. Canada has other avenues; there is a lot of government support available if you know how to get to it, as well as many PE firms with capital to deploy.

JR: There has definitely been a growth in BDCs. It’s always good to see more capital being put to work, however, this isn’t really of radical importance to today’s M&A market drivers. An interesting trend in mid-market financing has been the rise of the family-office investor. These are wealthy family-office individuals putting their capital to work. They are often entrepreneurs who have previously worked in the mid-market space. They understand mid-cap firms, and they want to partner up with them. For these family office investors it’s about wealth creation, and they’re increasingly going for the direct investment route.

JB: The mid-market financing environment remains deep and liquid. BDCs and commercial finance companies offering unitranche financing structures are flexible and commercial in approach. These structures typically involve limited amortization, which provides a lot of flexibility, particularly in situations where companies hit a soft spot. Due to the strength of the equity market the yield requirements of unitranche financings have decreased.

SS: BDCs are a new arm of financial institution really designed to drive early stage firms, much like VC. Essentially it is another capital source helping mid- market companies that may have previously been looking at banking or VC, but don’t want to lose the control that is often associated with the latter. Also, due to current rates, they are also very cheap.

Overall, this continues to drive down the cost of capital by adding another source. It is increasing competition.

MH: I would say other financing initiatives are the larger impact. The big one in terms of other financing initiatives is what’s going on with

the banks and the limitations on the amount of leverage. However, leverage caps are out at 6x-6.5x EBITDA right now, given the focus of the regulators on absolute leverage that’s paid on the models. This differs from what we’ve seen in historical markets, and if you look at 2006-2007 and the driver of acquisitions during that time, sponsors were driving a substantially larger percentage of M&A volume than we had through the rest of the cycle. If you look at this part of the cycle, over the past 6-12 months, you’ve seen PE volumes come down dramatically as a percentage of the overall market. That’s because absolute leverage levels aren’t going as high as they were during the 2006-2007 timeframe. At the same time we’re seeing corporate buyers being much more active than they were back then.

PE volumes have fallen from 50%-60% down to 40% of total M&A volume from the first half of this year and I think it’s driven by the combination of leverage of PE firms being prudent in the current valuation environment and then corporate buyers are getting compensated in the market for making the right acquisition so corporate buyers are being pretty aggressive.

MM: How is private equity activity affecting mid-market transactions?

CW: It is a very competitive environment for private equity right now. They have raised huge amounts of capital and are keen to deploy capital. On top of this, strategic acquirers are well positioned to compete, which is helping to drive up values. In part, this competition means now that private equity is looking at different asset classes, for example, in the infrastructure space. PE in 2015 is a lot more aggressive.

JR: Private equity will always be a critical part of mid-market M&A, however from our perspective it is almost 20% down from last year’s volume despite overall M&A levels being similar. That means the key driver of this current M&A market has been the rise of the aggressive strategic buyer.

“Private equity will always be a critical part of mid-market M&A, however…the key driver of this current M&A market has been the rise of the aggressive strategic buyer.”

— James Roddy, Head of Mid-Cap Investment Banking and M&A, J.P. Morgan

JB: There’s just an enormous amount of private equity. Forty-five percent of US mid-market businesses are being sold to PE firms and 55% are being sold to strategics — that’s a pretty good balance. In years past we’ve seen it as lopsided as 80/20. Currently there’s about $1.5tn of cash on corporate balance sheets and $500m+ of PE capital that needs to be deployed. You’ve got really receptive lending markets thinking that all these commercial finance companies and alternative lenders have blossomed— with a combination of all that, you’ve got tons of liquidity. It’s a sellers’ market — there’s an imbalance of quality companies in the market relative to the amount of capital chasing those companies.

PE buyers that have conviction and are focused on industries, they are great buyers. The strategic buyers can be quite fickle and if the PE guys act with conviction they can often times out-execute some of the strategic buyers. PE guys get paid to do deals, that’s what they do so they need to be nimble and capable of getting deals done, which isn’t easy.

SS: Mid-market M&A is now frothy from a multiples perspective, particularly in the technology space. However, mid-market PE is now looking at these deals as an opportunity to clean up portfolios and gain assets. When getting them, they are being very strategic and prescriptive in what they buy. We’re now at a stage where they are competing with the financial institutions and the big buyers. It also helps that funding is cheap.

MH: I wouldn’t actually say that PE activity has increased that much in what we’ve seen. What we’ve seen is that corporate competition has gone up and that’s what’s been driving volumes over the past six months and so we see more corporate competition than historically, and that’s caused us to continue to deepen our focus on the leader strategy and corporate carve-outs and transformational mergers to help make us a quasi-strategic acquirer.