The North American mid-market has cooled somewhat this year after a huge 2014. But with so many factors at play, what do the next 12 months hold? Virtual data room provider Firmex worked with Mergermarket to ask industry experts for this edition of our quarterly report on North American mid-market M&A.

Foreword

The image for North American mid-market M&A in 2016 is clearer as we enter December. And the numbers so far this year paint a picture of a market segment bursting with opportunity, yet also looking over its shoulder.

Much of our September panel’s discussion points are taking fruition, as the impact of BDCs and strategic acquirers takes hold. The emergence of both cheaper financing and more competition is consequently generating more interest in what the mid-market has to offer.

Elsewhere, however, caution is taking hold of the segment. Low oil prices, while driving down operating costs, are hurting energy firms as well as creating uncertainty. Similarly, the unclear outlook for interest rates and the US presidency present concern and apprehension.

Overall, however, this edition’s panel remains positive regarding the opportunities for North America’s mid-market over the next year. But players need to act with certainty and think about what makes them stand out when it comes to M&A. Companies operating in the mid-market must decide on which direction to turn in 2016.

Mergermarket (MM): As we head into the New Year, what are the current factors defining M&A in North America’s mid-market?

Jerry Black (JB): The market has been driven by factors such as the low cost of financing — principally as a result of low interest rates — the economic stability, and positive economic growth in the United States, compared with most of the rest of the world and the demographics resulting in baby boomers reaching retirement age. With the latter, they are wanting to sell their companies, primarily to generate liquidity and to maximize current market values.

In addition, many companies are now more inclined than they were in the past to pursue growth through acquisition. They recognize that the purchase of an existing business that aligns or expands upon current operations is a faster path to growth or that certain new or synergetic business lines and support capabilities will complement their business operations and growth.

Important limiting factors as a result of recent acquisition activity in M&A generally, including the mid-market, are a smaller supply of quality acquisition targets and increased valuations. Finding companies which do not have inflated valuations and do not create excessive risk in terms of meeting the acquirer’s financial and business objectives will be more of a challenge. In light of the larger transactions consummated more recently, competitive pressures are causing an increase in mid-market transactions in order to accelerate growth and result in higher valuations.

T. Patrick Hurley, Jr (PH): For the owner/operator, family business or entrepreneurial group, it’s been a question of whether it’s time for them to do something. If we’re talking about selling — whether it’s based on age, health or having a good record — they don’t want to go into poor market conditions, but the market conditions are less of a factor than whether it’s time for them to consider something. In one recent case, it’s been because there was a significant funding issue related to the scale that they needed to be — this was a company doing about $80m in revenues that decided that rather than go out and possibly get stomped, they needed to find a partner that had the strength and motivation that would pay them a very nice value, and were willing to do it on a combo of about 50% current in the price and 50% in an earnout where they really believed in it.

Elsewhere, we had an owner of a hospitality operation who was being told by everyone he was rich but he didn’t feel like he had enough money in the bank. After he talked with us we did a transaction with his existing bank that got him nearly all of his previously taxed capital out of the business, and no sponsor, no dilution in equity and a reasonable debt level. It’s altogether a different environment from the sponsor because they’ve paid a high price, and it becomes very difficult for management teams to ever meet their expectations.

Eric Zoller (EZ): For private equity (PE), the overarching theme in the market is one of contrast. From a seller’s perspective they are beginning to view the market as potentially having peaked. We haven’t quite seen a softening of their demands for prices necessarily, but I think maybe now there’s a realization that it’s time to think about exiting if you haven’t done so. There’s increased volatility in the market, and people aren’t sure for how much longer the markets will hold up.

Dry powder still continues to be at a post-crisis high, with about $400bn of dry powder. On top of this, there’s about 2,300 funds seeking $770bn of new capital. That means the number of players chasing deals and entering the market continues to grow each quarter. And as more and more money flows into the market, that should provide nearterm support.

Another driver of pricing has been the rise of direct lending funds. Rather, it’s actually a symptom of the market in many ways. Several years ago the total capital raised for direct lending funds was $7bn. Now, that is closer to $35bn over the last four years. This is being driven by the strong demand by sponsors and others for lending given the rise in deal activity.

Despite the strong deal flow and heavy dry powder, the contrast is that buyers themselves are becoming more concerned about valuations as we hit the peak of the market. They’re sitting on this dry powder a little longer, trying to be more thoughtful about picking their spots. A few years ago, 80% of the market was PE-backed. Now our stats show that M&A activity for PE sponsors is closer to 45%. That’s a big drop.

“Buyers themselves are becoming more concerned about valuations as we hit the peak of the market…they’re trying to be more thoughtful about picking their spots.” – Eric Zoller, Managing Partner at Sixpoint Partners

David Horing (DH): Two factors I would highlight would be interest rate sentiment and wider issues facing the global economy. Interest rate sentiment, and the uncertainty over the timing of rate increases, has created increased volatility in the debt and equity markets. This in turn has the potential to lower confidence amongst business leaders and may also serve to dampen valuations.

Regarding the wider economy, the slowdown in China is trickling through to US businesses. One significant impact has been falling commodity prices, which influences our economy in multiple ways. Secondly, the strengthening of the US dollar has become a noticeable drag on some US businesses, putting pressure on earnings.

MM: What do you think will happen to commodity prices in 2016, and how will that impact US and Canadian M&A in the mid-market?

JB: In light of continued economic weakness in much of the world, especially in countries such as China and Brazil, there is likely to be reduced demand and continued weakness in the prices of commodities, particularly oil. This should have a positive impact for reduced operating costs of mid-market companies, as well as businesses and consumers generally, and should improve the revenue and profitability of target companies.

As a result there should be attractive opportunities, particularly in the energy sector with the valuation of targets reduced and the need for consolidation as a result of financial and business uncertainty. More mid-market and even lower mid-market companies are becoming targets, unlike in the past when size disqualified smaller targets for PE funds, as a result of down market interest as acquirers search for desirable acquisition targets.

PH: While the producers specifically are being hurt so badly, there’s a real benefit to the people that are, for instance, buying plastics, which depends so much on the price of oil. Those businesses are really benefiting from this swing.

On the other hand, there’s no question that we’re going to see an upside in oil and metals. But we’ll also see continued price rises in other commodities such as food. People are saying there is no inflation – but depending on who you are, there’s been material inflation at the wholesale level.

“For the owner/operator, family business or entrepreneurial group…the market conditions are less of a factor than whether it’s time for them to do something.” – T Patrick Hurley, Jr, MidMarket Capital Advisers

EZ: There are two schools of thoughts now around commodities. The first is the idea that commodity prices have hit a trough and now’s a great time to enter the market. We’re already seeing examples of this, with funds in the secondary market that are mature and heavily invested trading at material discounts. Funds with established portfolios are pricing at very low prices, and people are concerned about this.

Investors that subscribe to the idea that the commodities market has reached a trough and that now is a good time to get in are spending their time going after early secondary funds, which are funds that have only invested a small amount of their capital, with a lot of dry powder remaining. People are very eager to get to those funds because they feel like deploying the uninvested portion of those funds in today’s environment will be quite attractive.

In contrast, investors subscribing to the idea that oil prices are going to be lower for longer and that commodity prices will be depressed for a longer period of time are holding off making new investments. These people believe that quantitative easing coming out of Europe and the easing coming out of China, as well as US interest rates, are really a sign of continued problems in the world and that will continue to put downward pressure on the demand side of commodities, and they’re better off holding off new investments in the market. If you think oil prices have hit bottom you’ll invest, if you think it’ll be lower for longer you will wait.

MM: It was recently mentioned that the Fed may look to postpone a rate rise until mid-2016. On top of this, we also have a US Presidential election in the same year. How will this uncertainty affect mid-market M&A in the US?

JB: The likelihood of a continued low interest rate environment will result in financing costs for mid-market acquisitions to be attractive for acquirers. Speculation that interest rates will increase after the next presidential election should result in acquirers being more likely to consummate acquisitions prior to the next presidential election to take advantage of the low financing costs. Concerns about rising interest rates, the increased national debt and the end of quantitative easing in the federal bond purchase program may contribute to a sense of urgency to take advantage of the current low interest rate environment.

PH: For me, rates will rise which will impact price. That means now there’s a bit of a rush for the higher-quality companies that can be traded.

These are being traded by professional owners, not traditional mid-market players thinking about their legacy and what happens in their community.

This is symptomatic of what’s happening to banks. They are being increasingly marginalized, and I don’t even think the sponsor community thinks about the commercial banks anymore. If you’re dealing with the BDCs today, you’re paying 6%-7% for the money you’re borrowing. And many of those BDCs have gone out and raised sub-debt at 10% to fund the deals that they’re charging people 6%-7% for. They make these deals to be able to produce a handsome return for, in many cases, public shareholders. There is a creativity that is taking place in the commercial finance and business development world which commercial banks can’t compete with.

“The likelihood of a continued low interest rate environment will result in financing costs for mid-market acquisitions being attractive for acquirers.” – Jerry Black, Akerman

EZ: I think near-term, the continued easing should give a bounce to the M&A market. It should at least allow the current market activity to continue. I think everybody expects once rates go up — and nobody knows when they will — for it to impact the cost of capital. When that happens, that should flow through the system, bringing down overall prices. In the near-term we’ll see continued stability and activity in the M&A market — a lot of capital is chasing a limited number of deals — so that should portend well for the market. If you believe that rates will rise in December or early 2016, we’ll start to see entry multiples on new acquisitions come down a bit.

We also talked about uncertainty in the market. I think capital flows are beginning to move much more into distressed and special situations or deep value. There’s a concern right now that so much of the buyout market is in that segment that it’s overbought. There’s a concern that as rates go up, funds who end up buying right now at the high point in the cycle will have a more difficult time achieving the high historical returns we’ve seen since 2009. LPs and investors are gravitating toward PE funds that have a true deep-value orientation because of the belief that funds with such strategies can buy assets at better entry multiples, or if not, at least they can orient their focus toward something that is more of a special situation where they can take a business, buy it at an attractive multiple, repair it and be better positioned for the exit.

DH: The Fed’s decision around interest rate policy clearly impacts volatility in both equity and debt markets. It’s hard to see sustained rate increases happening over the next 12-18 months. This is partly because the environment is relatively fragile, but it’s more the psychological role — the idea that interest rates can add volatility to the market — which would have the potential to slow down activity.

Loans in our market typically have a LIBOR floor which effectively means that until interest rates move a certain amount — 100 basis points, for instance — it won’t directly affect borrowing rates. The psychology of rate changes, however, could certainly impact volatility and valuations, but it would take time before we actually see an impact on borrowing costs.

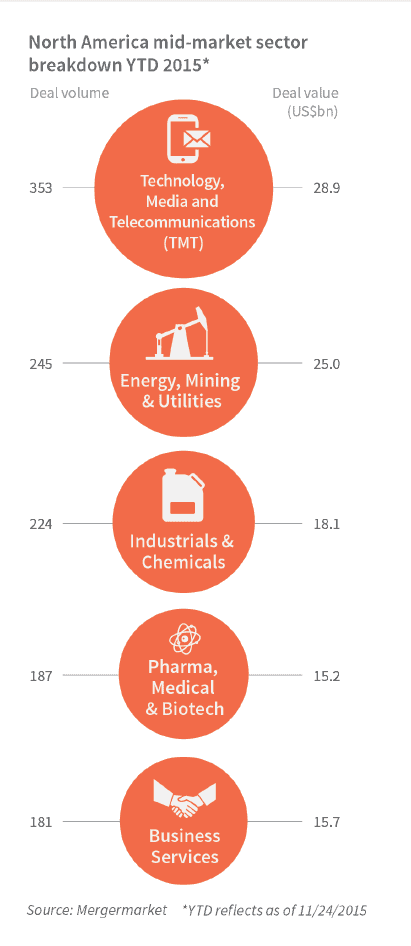

MM: Technology has obviously had a stellar year in 2015 – but which sectors do you think will really come under the M&A spotlight regarding the North American mid-market in 2016?

JB: North American mid-market M&A will probably be characterized by continued interest in healthcare transactions, driven in part by the restructuring of the healthcare industry caused by the Affordable Care Act. With this, big pharmaceutical companies are pursuing growth as anchor drugs go generic, and there is a search for life sciences and healthcare IT innovation. The larger and stronger companies in this sector likely will continue to see the need to increase size for regulatory reasons, and many targets will have to seek consolidation for survival resulting from business pressures such as declining reimbursements in the healthcare business and increased operating costs.

In addition, with reduced demand or excess supply in the oil and commodities sector, this should be another area of mid-market acquisitions. Construction and building supply companies could also face increasing demand after a number of years of reduced construction activity. In the food and retail sectors, there is a greater interest in PE investment without requiring control.

“We’ll see a lot of activity in the energy sector because so many companies are under pressure from lower oil prices and will need to consolidate.” – David Horing, American Securities

PH: It’s really across the board. Recently there was an announcement that Pep Boys is being acquired by Bridgestone at the same price that they had a deal three years ago fall apart with Gores Group – and it has lower earnings today than it had then.

Elsewhere, businesses in specialty retail, restaurants and software as a service have been highly sought after. But our client base tends to be more industrial, and there’s a will to sell because in low-growth industries, the only way to grow is to buy. If you’ve got industrial controls and meters and devices that are used in products that may ultimately go to a consumer, those businesses are attractive for M&A because of the industries they’re in are not growing fast enough.

EZ: From where we sit, interest in tech, tech-enabled funds and tech buyouts continues to be very strong, and that should continue through the next year. If you look at the softening of the public equity markets over the last quarter, the one exception to this interest has been technology-led buyouts. This segment has continued to perform well and we’ll continue to see strong investor demand for it. Interestingly, we’ve seen a number of funds that focus on heavy manufacturing introduce a tech-enabled component to their strategy. We’re seeing a demand for a fusion of old-world companies with more technology angles to them.

There’s also continued interest in consumer right now because the market is orienting itself more toward sector specialists. In an environment where there’s high valuations, investors are looking at more growth-oriented sectors to justify the higher prices that they’re paying. You can typically find that in the consumer sector.

Finally, healthcare continues to benefit in this market. This year has been a very strong year for healthcare M&A, influenced a lot by the regulatory environment and the need to consolidate and seek efficiencies in the industry. This will continue and also offers a defensive play.

DH: I think we’ll also see a lot of activity in the energy sector because so many companies are under pressure from lower oil prices and will need to consolidate. We also see a lot of activity in healthcare as Eric mentioned. The evolution in healthcare laws, including the Affordable Care Act, is driving consolidation in this industry as well.

MM: What do you think the fundraising environment will be like for mid-market buyers in 2016?

JB: The availability of capital from lenders and PE funds should not change much. Interest rates should stay low until after the 2016 presidential election, since the Fed may not want to appear to be responding to political considerations. In the current investment environment with low-yielding debt not providing an attractive investment return, PE firms should be able to access additional capital for their funds for investment and transactional purposes. This is in part the result of the relative outperformance of PE compared to alternative investments and the increase in the number and size of PE firms formed in the last 10 years.

PH: Capital’s always available. There’s no shortage of capital for people to do things, and they can do it without having equity partners. The dramatic expansion in the mezzanine business and lots of sources for subordinated debt has enabled this. While the initial reaction for needing to pay 10% for that is negative, when it’s compared with the alternatives of having a partner, it’s usually not bad if things go well and it can be paid off early.

The mid-market buyers are going to succeed in purchasing companies that are owned by nonprofessional owners. The mid-market company generally is not accustomed to dealing with a seller who chooses their buyer based on the prospective buyers’ markup of their agreement and willingness to buy rep and warranty insurance. They have negotiated transactions which are loosely based on having some kind of knowledge dating way back, and a belief that they will be a good fit.

EZ: The fundraising environment for PE is still a bifurcated market between restructured funds on the one hand, one-and-done funds on the other hand, and the wide middle of GPs who are taking usually 16 months to raise a fund. It’s a crowded market in the middle, and they need to do a much better job of differentiating themselves to LPs. However, the fundraising market is strong and the time it takes to raise them should come down in the next year.

On the deal-by-deal capital raising side as opposed to the fund level, there’s a lot of interesting dynamics happening here, particularly around co-investment. Over the last two years, a lot of money has been raised for discreet, co-invest capital vehicles. A lot of LPs and traditional investors that historically only invest in PE funds are now getting into the deal-by-deal business. This has contributed to the growth in the amount of dry powder going after deals, and it has also contributed to creating a tipping point in the market, where investors are now willing to pay fee/carry for access to direct deals.

This ability of the GP to earn fee and carry on co-invest deals is different to anything we’ve seen in the last couple of years. It’s been a big focus for our firm.

DH: The fundraising market is pretty strong, especially for the top funds with long-established track records and stable teams. I expect that that will still be the case next year.

PE has outperformed other asset classes for a sustained period of time. This performance has generated interest from a deep well of capital, including large international pools of capital, and this interest is still growing. For funds that have struggled in terms of performance, however, it will remain much more challenging to raise funds. But overall, PE returns have been good and the market is fairly healthy, so the fundraising environment should be favorable.

MM: What are the opportunities and challenges for mid-market PE in 2016?

JB: PE firms are reaching out to smaller companies at the lower end of the mid-market as part of the search for potential targets. The challenge on the acquisition side will be to find targets with reasonable valuations in light of a potentially diminishing supply of targets, as well as competition among PE for suitable acquisitions and increased competition from strategic purchasers.

PH: Even the $500-600m under management funds would say there’s good deal flow, but that prices are an issue. However, mid-market owners today are unlikely to be impressed by a PE fund. They’re just the next one. So distinguishing themselves and being able to be viewed as having real value is a challenge PE must meet.

The benefits that sponsors have is that they make things move-in ready. It’s got professional management with a growth plan, it’s got strong controls, be they financial development, IP and understanding of regulations. This is frustrating for somebody that has a business that maybe needs more work but can’t get the same multiple — even though it would be well worth the work for a buyer to do that. There’s disappointment out there in the owner/ operator community because they have a different level of discipline about managing the value of their businesses, and PE could look to tap into that.

“Distinguishing themselves and being able to be viewed as having real value is a challenge private equity must meet.” – T. Patrick Hurley, Jr, MidMarket Capital Advisors

EZ: I think there will be a lot of spin outs in the market going forward. We saw in the early wave of spin outs right after the crisis, a lot of teams came out of the banks who got out of the business. Now we’re seeing a new dynamic where new fund creation is driven by funds who raised a lot of capital pre-crisis but are unable to raise a fund today. This means you have teams spinning out of those legacy funds. Garnering interest from investors for spin outs is a big opportunity for PE in 2016. The second big opportunity is to develop relationships with LPs through the co-investment process.

Another challenge is fee compression. Managers are under pressure from investors in terms of the fees that they can charge portfolio companies. There are lots of regulatory challenges for private equity funds in terms of greater scrutiny and a greater need to focus on transparency and reporting to LPs.

The overarching challenge, in the fundraising market, is differentiating yourself. With over 700 funds raising close to $800bn — how do you differentiate yourself in the eyes of the investor?

DH: The recent choppiness in the debt markets should create good opportunities in 2016. We see some banks are hung with loans and/or are unwilling to finance certain new deals. We have seen in prior credit cycles that these dislocations can create great buying opportunities for PE firms that are able to take advantage at potentially more reasonable valuations.

Despite this, the biggest challenge in our market continues to be valuations, which are at an all-time high, making it hard for buyers. And it’s a market that continues to remain pretty competitive. PE funds tend to have quite a bit of capital to deploy and corporate buyers with liquid balance sheets have been active as well, so we see a competitive market and expect that trend to continue.

Special guest commentary: Tom Stewart of the National Center for the Middle Market explains why companies in the middle ground are crucial to the US economy.

Mid-market companies have been a pillar of strength for the North American economy in the last decade, standing tall when others have floundered. Now, they are using the optimal market conditions as well as their own initiative to make waves in dealmaking.

Pillar of strength

The mid-market’s strength has been seen in the past. In the aftermath of the Great Recession, 8.8 million US jobs were lost, according to the Bureau of Labor Statistics. By contrast, between 2008 and 2010, midmarket companies actually added jobs. During this period, surviving mid-market businesses added more than two million jobs, while surviving large businesses shed nearly four million. They continue to grow strongly. Top-line growth for middle market firms in the last four quarters has been, on average, 7.2%.

Mid-market companies have also been prudent and play a long game. Instead of overburdening themselves with debt or outside capital to grow, many mid-market firms prefer to pay down debt and self-fund. Indeed, according to our research, almost a third of small and mid-market firms have not raised capital in the last three years, while roughly 40% do not think they will raise outside capital in the coming three years.

Desire to deal

While the mid-market has been growing strongly organically, companies in the segment also realize that acquisitions are useful. Low interest rates are, of course, certainly incentivizing companies who want to acquire. However, the fact that mid-market companies are well positioned already means they are not as prone to macroeconomic factors as other firms. Perhaps because they prefer to fund investments from retained earnings, mid-market firms are in the main not too concerned about potential rising interest rates, at least when it comes to funding acquisitions.

There is a general attitude of buying as and when you must, and not just necessarily reacting to outside events. This is seen in our research. In Q3 2015, 15% of companies with revenues between $10m and $1b said they expected to make an acquisition in the year ahead. And 27% of companies between $100m and $1b said that they expect to do a deal over the next 12 months.

PE interest

Private equity firms are also keen on investing more into mid-market North American firms. And rather than investing in order to strip assets and reduce costs, PE firms in this segment are looking to help the mid-market grow further. They want to buy in to companies, improve their management and update technology and so forth, and bring mid-market businesses into the 21st century.

Sector-specific factors are also playing a role in midmarket dealmaking. Healthcare, for instance, has been very active, much of this coming from consolidation and opportunity as the impact of the Affordable Care Act continues to take hold.

The mid-market’s role as the most powerful engine of growth in the US economy is not as widely recognized as it should be. Alongside this, dealmaking can provide these companies with a platform to accelerate the growth further. As the mid-market’s success continues, it’s important to recognize that, enable it, and acknowledge that this is the hotspot for the economy.